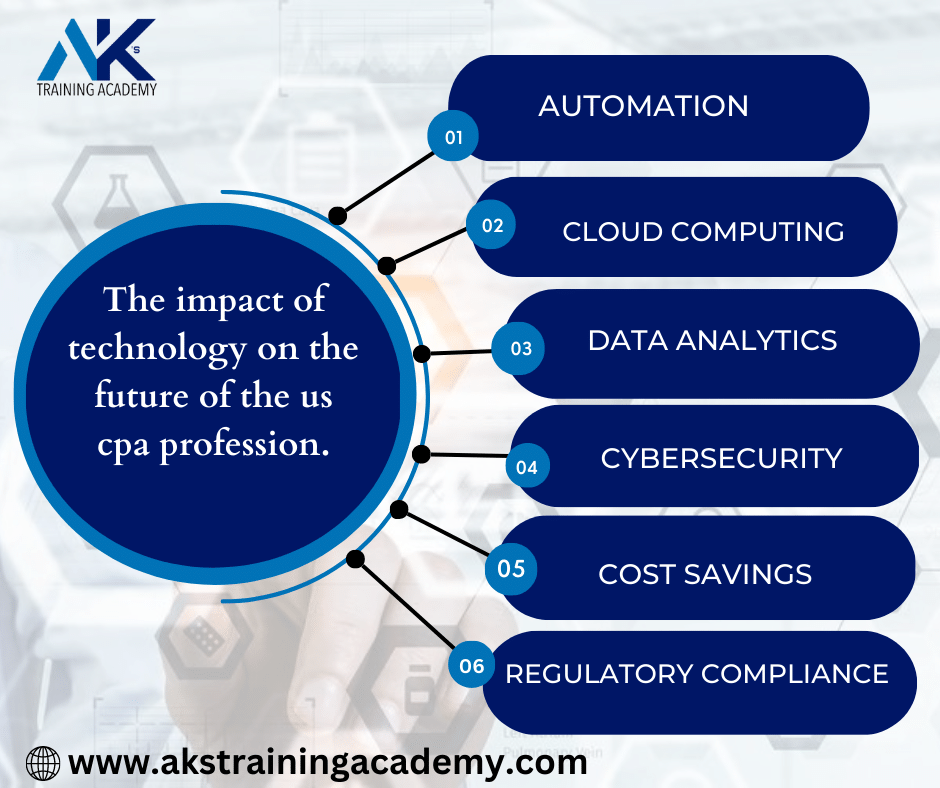

The trajectory of technological growth is not showing any signs of slowing down anytime soon. This unprecedented pace of growth has an impact on all industries, including the accounting profession. As technology evolves, so do the skills and expertise required of accountants. With the rise of automation, cloud computing, data analytics, and cybersecurity, the role of Certified Public Accountant (CPA) is changing rapidly.

You may be wondering how these changes will impact the future of the US CPA profession. If technology will make accounting jobs obsolete, or will it create new career opportunities? The accounting profession is experiencing a transformational shift as a result of technology. In this blog post, we will explore the impact of technology on the future of the US CPA profession.

Impact 1: Automation

You must have heard how industries are looking for ways of automating their production cycle. The same is true for accounting wherein the routine tasks are left to the automated systems. Such tasks as data entry and reconciliations can now be automated, freeing up accountants to focus on more complex tasks.

Accountants can now use Machine Learning and Artificial Intelligence to analyze vast collections of data rapidly and without error. They can then use this to identify potential problems and provide solutions driven by analytical insights.

More and more functionalities of account keeping are going to be automated in the future. Accountants will need to adapt to keep up with the changes since their role will no longer be limited to data entry. They will need to develop the skill and knowledge of data analysis to remain relevant in the changing times.

Impact 2: Cloud Computing

Since all data is stored in cloud-based software, accountants have the benefit of accessing financial data from anywhere or anytime. Accountants can thus work remotely which improves their work-life balance. It also helps by reducing the need for physical office space.

An accountant’s job is no longer a solitary prospect thanks to cloud computing. It has improved partnerships and communication among accountants, clients, and other stakeholders. Many users can work on one data set simultaneously, thereby improving efficiency and reducing the chances of errors.

Impact 3: Data Analytics

Data analytics is increasingly becoming a crucial part of the US CPA profession. These professionals have to make sense of large chunks of data and provide insights to businesses to avoid risks. Data Analytics software has made their job easier, as it can study data quickly and precisely. This software can also detect fraud, identify trends, and thus help to make informed business decisions.

Accountants will need to understand how to work with data analytics tools and be able to communicate the insights they generate to clients and other stakeholders. As more and more use of data analytics becomes prevalent, accountants will need to upgrade themselves. They will need to learn how to run data analytic tools and also be able to communicate the insights they have gained with other stakeholders.

Impact 4: Cybersecurity

Accountants have access to the lifeblood of the company in the form of its financial data. It is their job to protect this sensitive information and prevent any data breaches. There is now an added risk of cyber attacks since most companies store their data in the cloud or on blockchains. If the attacker is successful in breaching through the defenses then the consequences can be severe.

As a result, accountants will need to be vigilant about cybersecurity threats and take steps to protect sensitive financial data. This may involve implementing stronger password protocols, using encryption to protect data, and ensuring that all software is up-to-date.

Impact 5: Cost Savings

Next, technology can create significant cost savings in the accounting profession. Accounting firms and their clients will benefit from the use of automation and cloud computing. These help in reducing the amount of time and resources required for routine tasks. Thus, they can be free to focus on higher-value services.

Additionally, because of cloud computing accounting firms don’t have the need for a physical office space. They can save on other overhead costs too, leading to significantly more revenue for accounting firms. This is so because, these cost savings can be passed on to clients, making the services more affordable.

Impact 6: Regulatory Compliance

Lastly, as more accounting services are being integrated with technology, the need for regulatory compliance has become vital. Accountants need to monitor financial transactions more closely and identify potential issues more quickly. The compliance requirements for accountants ensure that they are meeting the latest standards and regulations.

If they fail to comply with these regulations, they will be penalized with serious fines and also cause reputation loss for the firm. To ensure compliance with regulatory requirements, accountants will need to stay up-to-date with the latest regulations and implement best practices for compliance.

Also read: Why CA Must Do CPA Course? Know More about CPA Course.

Conclusion

Thus, you can see that the impact of technology on the US CPA profession presents both challenges and opportunities. Traditional accounting roles are becoming redundant new professionals must explore career opportunities in emerging areas of accounting. Ultimately, the impact of technology on the accounting profession is likely to be positive, leading to cost savings, increased efficiency, and improved job opportunities. By embracing the changes brought about by technology, accountants can position themselves for success in the future.